There is more to a Merger and Acquisition process than just drafting the agreement.

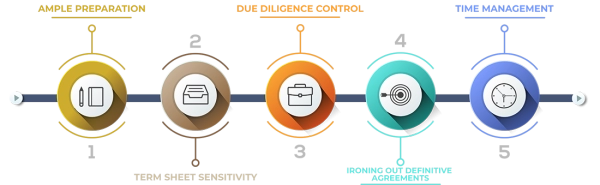

Successful closure requires ample preparation of all parties, keen understanding the sensitivities of a terms sheet, controlling the due-diligence process and ironing out the definitive agreements, all in a timebound manner to achieve maximum effectiveness of the M&A process.

Rodschinson Investment is a prominent investment advisor with a several successful execution of diverse M&A transactions across Europe and internationally.

The Team’s diverse expertise and intrinsic understanding of the process enable us to identify the critical junctures of the M&A transaction and ensure smooth progress towards closure.

Ample Preparation

- At Rodschinson Investment, our team initiates a diagnostic for every M&A transaction to highlight core nuances and growth areas of the business ahead of time. Thorough review of data and mock rounds with the management ensure that the client and stakeholders have a clear understanding of the salient features of the process and best course of action for various scenarios.

Term Sheet Sensitivity

- Generally, the agreement of terms happens at the middle of the transaction hence are pivotal as they are represent the understanding communicated between parties basis initial information exchange and also serve as the basis for due diligence and definitive stakeholder agreements. The Rodschinson Investment team possesses extensive experience of successfully closing M&A transactions for developments and is mindful of the sensitivities associated with the Term sheet stage by liaising with all transaction stakeholders, providing clear representation of client’s intent and ensure clarity of data, financials and business direction between all parties.

Due Diligence Control

A time consuming and exhaustive process, the Rodschinson team puts their best in insulating the business from the demands of the process so day -to -day business is not adversely effected.

We liaise between lawyers, vendors and consultants for legal, technical, commercial diligences and maintain the flow of information to ensure the process is quickly closed.

Ironing Out Definitive Agreements

- A definitive agreement could have lasting impact and liabilities in the business and the stakeholders even if they are divesting. At Rodschinson Investment, we keep a track of appropriate provisions and clauses like representation and warranties, baskets, post transaction liabilities and recourse effects to ensure the agreement a client executes is aligned with their intentions and objectives.

Time Management

- Mergers & acquisitions can be a strenuous activity and often there are instances of transactions spilling over into years. The Rodschinson Investment team is well aware of the repercussions such lengthly spillover of timelines have on business operations, costs and environment of the company. With a thorough approach with well defined steps we ensure that clients can swiftly go to market and execute transactions in a timebound manner.

Specialists for every situation

Rodschinson Investment is your trusted investement partner to make the smartest possible move whatever is your current situation.

Bastion Tower (level 11-12)

5, Place du Champ de Mars

1050 Brussels, Belgium